In January 2016 the International Accounting Standards Board (IASB) issued IFRS 16, ‘Leases’, and thereby started a new era of lease accounting – at least for lessees! Whereas, under the previous guidance in IAS 17, Leases, a lessee had to make a distinction between a finance lease (on balance sheet) and an operating lease (off balance sheet), the new model requires the lessee to recognized almost all lease contracts on the balance sheet; the only optional exemptions are for certain short term leases and leases of low-value assets. For lessees that have entered into contracts classified as operating leases under IAS 17, this could have a huge impact on the financial statements.

An entity shall apply IFRS 16 retrospectively for annual periods beginning on or after January 1, 2019

So Why IASB introduced this new era of lease accounting??

Historically, Lease accounting (IAS17) focused on lease classification:

A) Finance Lease – where a lease is economically similar to purchasing the underlying asset and reporting the asset (& liability) on balance sheet

B) Operating Lease – where a lease gives rise to an:

Asset: “A resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity”

Liability: “A present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.”

Neither of which are reported on the balance sheet nor are disclosed only in the notes to the financial statements (as an Operating Lease).

This somewhat arbitrary distinction, made it difficult for investors to compare companies. There was also criticism from investors that reported balance sheets provide a misleading picture about leverage and leased assets used. This meant that investors (and others) had to estimate the effects of a company’s off balance sheet lease obligations, which in practice often led to overestimating the liabilities arising from those obligations.

To manage the criticism received for IAS 17 accounting treatment of leases, the International Accounting Standards Board (IASB) introduced a new Leasing standard: IFRS16.

Scope of IFRS16

IFRS 16 defines a lease as a contract that conveys to the customer (“lessee”) the right to use an asset for a period of time in exchange for consideration. Fulfillment of the contract depends on the use of an identified asset and control of the use of the asset during the lease period.

A Lease involves the use of an identified asset:

• Explicitly or implicitly specified (can also be a physically defined smaller part of bigger asset)

• No identified asset exists if supplier has a substantive right to substitute the asset

• A supplier’s right to substitute an asset is substantive if both:

– The supplier has the practical ability to substitute the asset, and

– The supplier can benefit from substituting the asset

A Lease exists when a customer controls the asset:

- Ability to direct the use of the asset

- Right to obtain substantially all of the economic benefit from the use of the asset

- Direction of asset – if the customer can decide how and for what purpose an asset is used and can change its use during the lease period

What are the key Changes?

- The new leasing standard removes the distinction between finance and operating leases for lessees

- Enhanced guidance is introduced on identifying whether a contract contains a lease

- A completely new lease accounting model for lessees that requires lessees to recognized all leases on balance sheet, except for short term leases and leases of low value assets is introduced

- Lessor accounting will not change significantly

So here is a brief of new lessee model:

- Balance sheet:

- Initially recognizes lease assets and liabilities on the balance sheet at Present Value of future lease payments.

- Income statement:

- Rent expense will be replaced with depreciation and interest expenses

- Recognizes amortization of lease assets and interest on the lease liabilities over the lease term

- The overall effect on profit will depend on the portfolio of leases an entity holds

- Cash flow statement:

- Separates the total amount of cash paid into a principal portion (presented within financing activities) and interest (presented within either operating or financing activities)

Classifying lease contracts in transition

- At the date of initial application, an entity is not required to reassess whether a contract is, or contains, a lease. The expedient must be applied to all contracts. This is however subject to conditions

- For contracts previously assessed under IAS 17 and IFRIC 4: Determining Whether an Arrangement Contains a Lease as containing a lease, IFRS 16 should, automatically, be applied to the contract

Implications for Corporates

Overview

The IASB expects that companies with immaterial or minimal off balance sheet leases transitioning from IAS 17 will not be significantly affected by IFRS 16, regardless of the terms and conditions of their debt covenants.

For those with substantial off balance sheet items the expected implications include:

- The assets and liabilities on their balance sheets will increase significantly, with a potentially material impact on covenant calculations.

- The cost profile of their income statements will change, with costs skewed towards the early years of leases and greater volatility due to the frequency of recalculation

- The nature of costs in the income statements will change, with a positive impact on EBITDA, but a greater weighting to finance costs and depreciation, again potentially impacting calculations of covenants. Depending on the wording of finance documents, this could also have an impact on cash sweeps, management bonuses etc.

- The accounting benefits of sale and leaseback transactions could be negatively impacted

- Companies should consider whether they need to renegotiate any loan or other agreements due to changes in their financial metrics

How will it impact financial metrics?

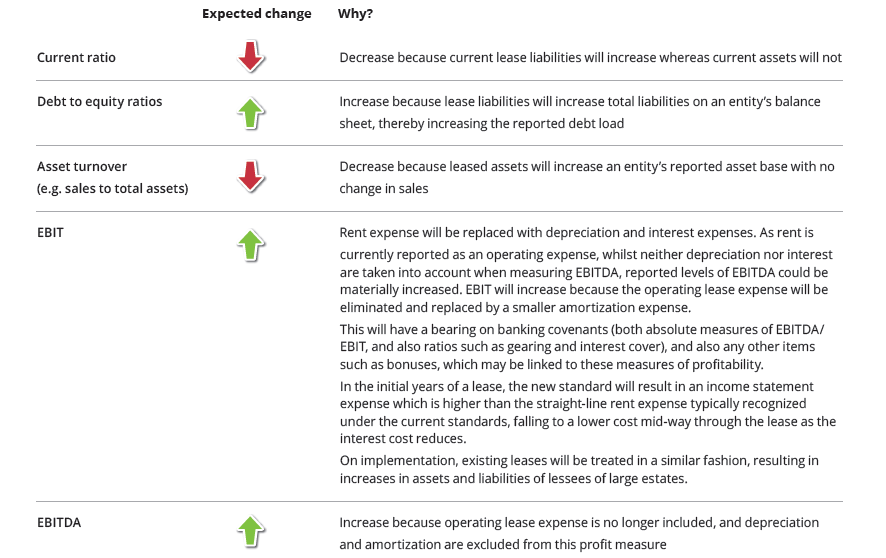

There may be some significant changes to a company’s key financial metrics, including the following:

Things to focus on while preparing for IFRS 16

- Assessing and Preparing information to analyses the impact of IFRS 16, analyzing the data and preparing for the longer term actions and decisions required

- Implementing and embedding system changes and making necessary changes to related processes and controls; developing in house tools to implement the calculations necessary for IFRS 16

- Mitigating and strategizing impacts on treasury, remuneration targets, covenants, regulatory matters and responding to changing tax requirements both in Cyprus and overseas

How should you be prepared for the new classification requirements under IFRS 16?

- Identify available and accessible information

- Assess the relevance, completeness and accuracy of the identified information

- Review accounting and operating systems: data extractions and compliance with new requirements

- Train relevant members of the finance team

- Communicate with members of other departments for the changes and impact

Key implementation considerations

Accounting

- Transition approach: Elect to use practical expedients for classification and measurement?

- Classifying contracts: Identify contracts not previously assessed in accordance with IAS 17 and IFRIC 4.

- Identify key contract features: Determine lease terms, value of lease payments, the implicit interest rate.

- Contracts with multiple components: Identify stand-alone selling prices and determine whether to apply the practical expedients.

- Deferred tax: Impact on deferred tax

- Disclosures: Determine the required disclosures and to what extent the disclosures aggregated.

- Documentation: New accounting policies. Documentation for key judgments applied

- Application of exemptions: Determine the threshold for low-value assets and whether to apply low-value assets and short-term leases exemption.

Operational

- Training of finance teams and other relevant departments.

- Review of IT systems.

- Determining what information is readily available.

- Review of the completeness and accuracy of the contract data.

- Review control procedures and lease approval processes.

- Internal controls over lease processes and accounting.

- Communication of changes and ensure project plan in place

Commercial

- Impact on future financing: Greater financial transparency

- Impact on tax payments and deferred tax: Timing of profit recognition

- Bonus schemes: Are targets based on EBITDA

- Changes to KPIs

- Compliance with loan covenants

- Compensation arrangements

- Procurement strategy: Lease or buy

How can SKGY help?

Review of lease contracts

- Taking inventory of all lease agreements and gathering the necessary data, including, among others, lease terms, renewal options and payment terms

- Prioritizing the analysis of those lease arrangements that are significant and/or have complex elements

- Identification of internal stakeholders- Discussing changes with relevant stakeholders, such as the company’s board of directors, creditors, analysts, key management personnel, etc.

- Interpretation of key judgmental areas.

- Determining whether any changes need to be made to debt covenants, loan agreements, bonus or compensation agreements

Business and accounting advice

- Identifying “data gaps” including information required from subsidiaries and affiliates operating in foreign jurisdictions

- Transition and ongoing impact analysis

- Changes in internal control and processes

- Asset procurement (lease or buy).

- Preparing pro-forma financial information to assess the impact of the changes to the financial statements

- Perform capital implication reviews and capital gap analysis for Financial institutions applying IFRS 16

- Review debt covenants included in contracts offered to customers by financial institutions and assess impact on capital and provisioning

To know more please contact SKGY Accounting team